Carbon credits represent a reduction of greenhouse gases in the atmosphere. Projects that prevent the generation of greenhouse gases or remove greenhouse gases from the atmosphere earn these credits, which can in turn then be "sold" to other businesses and individuals to "offset" the emissions they generate. So where do these carbon credits come from?

Carbon credits fund environmental projects designed to reduce CO2 emissions including:

- The removal of carbon dioxide from the atmosphere and the storage of it in a “sink” e.g. forestry;

- The reduction of carbon dioxide emissions by replacing fossil fuels with renewable energy sources e.g. wind and solar energy;

- The capture of greenhouse gases and alternative use or destruction of them e.g. methane capture at landfills;

- The reduction of emissions through energy efficiency, e.g. reduce the amount of fuel or electricity needed.

Who Buys carbon Credits?

There are two markets for carbon offsets. In the compliance market, companies, governments, or other entities buy carbon offsets in order to comply with regulations on the total amount of carbon dioxide they are allowed to emit.

In the voluntary market, individuals, companies, or governments purchase carbon offsets to mitigate their own greenhouse gas emissions from transportation, electricity use, and other sources.

Those buying voluntary credits to offset their emissions are generally buying for Public Relations/branding and Corporate Social Responsibility reasons. The next most common reason for purchases in this market is as a “pre compliance buy” (those buying in anticipation of regulation).

Other buyers are purchasing offsets for branding and competitive advantage reasons and taking action on greenhouse gas emissions to address the threat of climate change. Some companies or individuals can reduce their emissions a little or a lot, and for others it can be extremely difficult, impossible or not economically viable to reduce their emissions. Purchasing credits earned from a verified emission reduction project can help to offset such emissions and in turn, the revenue earned from the sale of those credits helps to fund that emission reduction project.

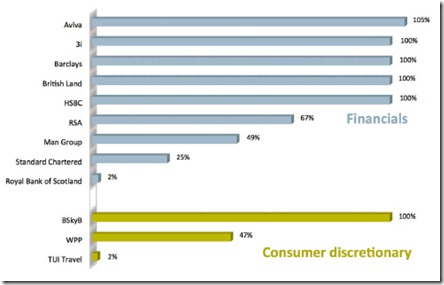

Who is offsetting? (Figures as of April 2011)

Twenty one FTSE 100 companies voluntarily offset at least a portion of their emissions. All of

these companies come from only three sectors: Financials, Consumer Discretionary and Consumer Staples.

Above: The number of companies in the FTSE 100 that use carbon offsets for at least a portion of their emissions. Sectors as categorised by the Carbon Disclosure Project.

| Financials | Consumer Discretionary | Consumer Staples |

| 3i | BSkyB | Imperial Tobacco |

| Aviva | Pearson | Reckitt Benckiser |

| Barclays | TUI Travel | Unilever |

| British Land | WPP | |

| Hammerson | ||

| HSBC | ||

| ICAP | ||

| Investec | ||

| Land Securities | ||

| Man Group | ||

| Old Mutual | ||

| RBS | ||

| RSA Insurance | ||

| Standard Chartered |

Above: Companies which purchase carbon offset credits. NB This table does not include companies which sell or facilitate the sale of offsets to their staff and/or customers, unless the company also makes a financial contribution. BP and International Airlines Group are therefore not included. Six companies claim full carbon neutrality

Only 11 of the 21 companies publically disclose the volume of carbon offsets purchased.

Six companies in the FTSE 100 are carbon neutral.

The diagram below compares the percentage of scope 1, 2 and 3 emissions offset for the 14 (of 21) companies that both offset and either disclose the quantity purchased or claim carbon

neutrality.

Of the companies that report their carbon footprint and the quantity of offsets purchased,

six have disclosed or suggested that they purchased credits totaling 100% of their annual

emissions or more. Aviva reports that is has a ‘5% margin of error’ in emissions data, so

offsetting an extra 5% ensures the robustness of carbon neutrality claims.

Above: The percentage of total scope 1, 2 & 3 disclosed emissions offset by each company.

NB Hammerson, ICAP, Imperial Tobacoo, Investec, Land Securities, Pearson, Reckitt Benckiser and Unilever have all disclosed that they have purchased offsets but are not included in this graph because they have not publically disclosed the volume of offsets purchased.

Carbon Expert enable our clients to purchase verified carbon credits and participate in an established globally recognised carbon trading platform.

We are among the leading brokers in emissions spot trading within the voluntary carbon credit market.

No comments:

Post a Comment